ESTABLISHMENT OF

CHICKEN LAYERS PROJECT

A

project is a planned set of interrelated tasks to be expected over a fixed and

within a certain cost and other limitations.

Our

project worth 20 million of which 15 million is the loan from Mkombozi Bank and

our own contribution is 5 million. This project is the benefit based with the

five year implementation. Different techniques of project decision criteria

will be used to determine if the project is recommended to be implemented. The

techniques are:

- · Benefit Cost Ratio (BCR)

- · Net Present Value (NPV)

- · Internal Rate of Return (IRR)

The

cost will be incurred by our project will be divided in the following explanations;

Read More: Project Planning and Management (A Case of Kwimba District)

EQUIPMENT COSTS

S/N

|

Equipment

|

Quantity

|

@

Price

|

Total

Cost

|

1

|

Chicken shed (rent)

|

1

|

2,000,000

|

2,000,000.00

|

2

|

Trays

|

100

|

2,000

|

200,000.00

|

3

|

Feeders at

·

Chick level

·

Chicken level

|

300

150

|

2,000

3,000

|

600,000.00

450,000.00

|

4

|

Electricity bulbs

|

50

|

1,000

|

50,000.00

|

5

|

Wheel barrow

|

2

|

50,000

|

100,000.00

|

6

|

Spade

|

2

|

15,000

|

30,000.00

|

7

|

Blooms

|

5

|

2,000

|

10,000.00

|

8

|

Exercise books

|

2

|

3,000

|

6,000.00

|

9

|

Pens

|

5

|

200

|

1,000.00

|

10

|

Weight

|

1

|

200,000

|

200,000.00

|

11

|

Generator

|

1

|

800,000

|

800,000.00

|

Grand total

|

4,447,000/=

|

|||

MATERIAL COST

S/N

|

Material

|

Quantity

|

@

Cost (price)

|

Total

cost (price)

|

|

1

|

Food

|

25,833 Kgs

|

275.00

|

6,625,000.00

|

|

2

|

Chicks

|

2,000

|

1,500

|

3,000,000.00

|

|

3

|

Drugs

i.

Antibiotics

ii.

Vaccines

|

60 Kgs

60 Kgs

|

4,000.00

4,000.00

|

240,000.00

240,000.00

|

|

4

|

Glucose

|

40 packets

|

500.00

|

20,000.00

|

|

Grand total

|

10,125,000/=

|

||||

OTHER COSTS INCLUDING LABOUR

S/N

|

Per month

|

Per year

|

Total

|

|

1

|

Four (4) people

|

100,000

|

1,200,000

|

3,600,000

|

2

|

Water

|

50,000

|

600,000

|

600,000

|

3

|

Electricity

|

20,000

|

240,000

|

240,000

|

4

|

Announcement and setting cost

|

5,000

|

||

5

|

Communication costs

|

20,000

|

||

6

|

Miscellaneous

|

963,000/=

|

||

Grand

total

|

5,428,000/=

|

|||

Loan from Mkombozi

bank has to be paid in the 10% interest rate

Provided loan is

15,000,000/=

How the loan is

going to be paid the bellow information explain

The compounding formula

needs to be used in order to find the future value from the present benefits.

Therefore, 15,000,000/=

million after five years

From;

FV = PV (1+i)t

Where,

FV

= Future Value

PV = Present Value

i = interest rate

t = time

Given;

PV= 15,000,000

I =10%

t = 5 years

FV = 15,000,000(1+0.1)5

FV = 15,000,000(1.1 )t

FV = 15,000,000(1.6105)

FV = 24,157,650

Future value is 24,157,650/= Tshs to be paid for 5 years.

Therefore, we are

required to pay Mkombozi bank 4,831,530 each year for five years at the

interest rate of 10%.

BENEFIT OF THE FIRST

YEAR

At

the first year the project will produce for six month; where per day will

produce 300,000/=, T.shs, per month will be 9,000,000/= Tshs and per half of

whole year will produce 54,000,000 which complete the first year (Gross

Benefit).

Costs

RUNNING

COSTS INCURRED DURING THE FIRST YEAR

|

|||

S/N

|

Item

|

Per

month

|

Total

Per year

|

1

|

Food

|

2,250,000/=

|

20,500,000/=

|

2

|

Drugs

|

40,000/=

|

240,000/=

|

3

|

Electricity bill

payment

|

20,000/=

|

120,000/=

|

4

|

Water bill payment

|

15,000/=

|

90,000/=

|

5

|

4 Labors

|

@ 100,000/=

|

2,400,000/=

|

6

|

Loan payment

|

-

|

4,831,530/=

|

7

|

Tax payment

|

-

|

13,500,000/=

|

Grand

total

|

41,681,530/=

|

||

Therefore,

Net benefit =

Gross Benefit – all costs

Net profit for

first year = 54,000,000 – 41,681,530

=

12,318,470/=

Net profit for

the first year is 12,318,470/=

BENEFIT OF THE SECOND

YEAR

The project will

produce 385,000/= per day for the second year which 11,550,000/= per month and

138,600,000/= per year (Gross Benefit).

Costs

RUNNING

COSTS INCURRED DURING THE SECOND YEAR

|

||||

S/N

|

Item

|

Per

month

|

Total

Per year

|

|

1.

|

Food

|

1,968,750

|

23,625,000/=

|

|

2.

|

Chicks

|

5,000,000/=

|

||

3.

|

Feeders

|

500,000/=

|

||

4.

|

Water bill payment

|

25,000

|

300,000/=

|

|

5.

|

Electricity bill payment

|

23333.30

|

280,000/=

|

|

6.

|

Tax payment

|

17,000,000/=

|

||

7.

|

4 Labors

|

@ 225,000/=

|

10,800,000/=

|

|

8.

|

Buying car

|

20,000,000/=

|

||

9.

|

Loan payment

|

4,831,530/=

|

||

10.

|

Transport cost

|

5,663,470/=

|

||

11.

|

Chicken shed renting

|

8,000,000/=

|

||

Grand

Total

|

96,000,000/=

|

|||

Therefore,

Net benefit=

gross benefit – all costs

Net benefit for

the second year = 108,000,000 - 96,000,000

=

12,000,000/=

Net benefit for

the second year = 12,000,000/= (undiscounted cash flow).

BENEFITS OF THE THIRD

YEAR

The

project will produce 300,000/= per day, 9,000,000/= per month and 99,000,000/=

per year. (gross benefits).

COSTS

Running

costs incurred during the third year

|

|||

S/N

|

Item

|

Per

month

|

Total

per year

|

1.

|

Food

|

2,250,000/=

|

35,000,000/=

|

2.

|

Water bill payment

|

16.666.60

|

200,000/=

|

3.

|

Electricity bill

payment

|

20,833.30

|

250,000/=

|

4.

|

4 labors

|

329,000/=

|

15,800,000/=

|

5.

|

Tax payment

|

2,250,000/=

|

27,000,000/=

|

6.

|

Transport cost

|

15,800,000/=

|

|

7.

|

Loan payment

|

4,831,530/=

|

|

Grand

total

|

93,081,530/=

|

||

Therefore,

Net benefit =

Gross benefit – All costs

Net benefits for

third year = 108,000,000/= - 93,081,530/=

Net benefit for

third year is 14,918,470/= T.shs

BENEFITS OF THE FOURTH

YEAR

The

project will produce 275,000/= per day for the first year, which is equal to

8,250,000/= per month and 99,000,000/= per year (Gross benefits).

COSTS

Running

Costs incurred during the fourth year

|

|||

S/N

|

Item

|

Costs

per Month

|

Total

Per year

|

1.

|

Water bills payment

|

18,333.30

|

220,000/=

|

2.

|

Electricity bill

payment

|

22,500/=

|

270,000/=

|

3.

|

4 labors

|

@ 225,000/=

|

10,800,000/=

|

4.

|

Food

|

35,000,000/=

|

|

5.

|

Chicks

|

6,000,000/=

|

|

6.

|

Tax payment

|

24,750,000/=

|

|

7.

|

Transport costs

|

5,500,000/=

|

|

8.

|

Loan payment

|

4,831,530/=

|

|

9.

|

Communication costs

|

500,000/=

|

|

Grand

total

|

87,871,530/=

|

||

Net

benefit = Gross benefit – All costs

Net

benefits for the fourth year = 99,000,000/= - 87,871,530/=

=

11,126,470/=

Net

benefits for the fourth year is 11,126,470/=

BENEFITS FOR THE FIFTH

YEAR

The

project will produce 165,000/= per day for the fifth year which is 4,950,000

per month and 59,400,000/= per year.

COSTS

Running

cost during the fifth year

|

|||

S/N

|

Items

|

Costs

per Month

|

Total

Costs per Year

|

1.

|

Water bill payment

|

18,333.30

|

220,000/=

|

2.

|

Electricity bill

payment

|

25,000/=

|

300.000/=

|

3.

|

4 labor payment

|

@ 300,000/=

|

14,400,000/=

|

4.

|

Food

|

32,000,000/=

|

|

5.

|

Tax payment

|

14,850,000/=

|

|

6.

|

Communication Costs

|

520,000/=

|

|

7.

|

Transport cost

|

8,000,000/=

|

|

8.

|

Loan payment

|

4,831,530/=

|

|

Grand

total

|

67,921,530/=

|

||

Therefore,

Net

benefit = Gross benefits – All costs

Net

benefit for the fifth year = 59,400,000/= - 67,921,530/=

=

-8,921,570/=

Net

benefits for fifth year = -8,921,570/=

After the analysis of

net benefits of each year, then we need to calculate; the Benefit Cost Ratio

(BCR), the Net Present Value (NPV) and Internal Rate of Return (IRR).

a)

THE

BENEFIT COST RATIO

Benefit

cost ratio (BCR) =

NPVt=8,212,723.95+5,332,800+4,420,342.66+2,174,970.77+-1,17 4,970.77-20,000,000

NPVt=18,988,768.7-20,000,000

NPVt=-1,174,970.77

Therefore, the net present Value (NPV) is equal to -1,174,970.77 which will be used as NPV2

Therefore,

the benefit cost ratio (BCR) of the chicken layering is 1.7. This project is

worth to undertaken.

a)

NET

PRESENT VALUE (NPV)

To calculate NPV is

given by the formulaNPVt + PV1 + PV2 + PV3… + PVt - Io

Before

we calculate the NPV we have to calculate the discounted cash flow at the rate

of 10%.

This is given by the

formula,

This

has summarized in the table below

NPV

(THE CASH FLOW IN T.SHs

|

|||

Year

|

Cash

Flow in T.shs

|

Discounting

factors at 10%

|

Discounted

Cash Flow

|

0

|

20,000,000/=

|

||

1

|

12,318,400/=

|

0.9091

|

11,198,721.08

|

2

|

12,000,000/=

|

0.8264

|

9,916,800.00

|

3

|

14,918,470/=

|

0.7515

|

11,208,246.51

|

4

|

11,128,470/=

|

0.6830

|

7,600,745.01

|

5

|

-8,921,570/=

|

0.6209

|

-5,539,402.09

|

NPV

|

33,845,707.79

|

||

From,

Therefore to calculate

the NPVt at the interest rate of 10% is given by:

NPVt + PV1 + PV2 + PV3… + PVt - Io

Given,

Io

PV1 = 11,198,721.08

PV2 =

9,916,800

PV3 =

11,208,246.51

PV4 = 7,600,745

PV5 = 5,539,402.09

NPVt=11,198,721.08+9,916,800+11,208,246.51+7,600,745+-5,539 ,402.09-20,000,000

NPVt = 33,845,707.79-20,000,000

NPVt = 13,845,707.79

Therefore,

the net present Value (NPV) is equal to 13,845,707.79

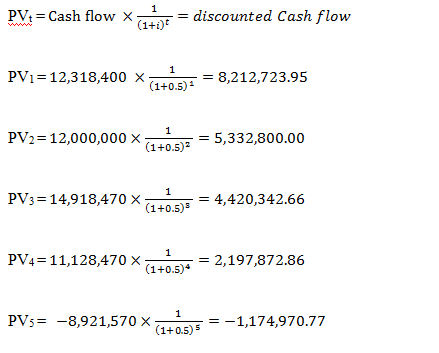

a) THE INTERNAL RATE OF RETURN

To calculate the

IRR there is a need of to find the NPV2 with a negative value

because there is already NPV1 with the positive value. The NPV2

here is calculated using at the rate of 50% as follows:

This has

summarized in the table below

Year

|

Cash

Flow in T.shs

|

Discounting

factors at 50%

|

Discounted

Cash Flow

|

0

|

20,000,000/=

|

Df = 1/(1+i)t

|

|

1

|

12,318,400/=

|

0.6667

|

8,212,723.95

|

2

|

12,000,000/=

|

0.4444

|

5,332,800.00

|

3

|

14,918,470/=

|

0.2963

|

4,420,342.66

|

4

|

11,128,470/=

|

0.1975

|

2,197,872.86

|

5

|

-8,921,570/=

|

0.1317

|

-1,174,970.77

|

NPV

|

18,988,768.7

|

||

From,

Therefore

to calculate the NPVt at the interest rate of 50% is given by:NPVt + PV1 + PV2 + PV3… + PVt - Io

Given,

PV1 =

8,212,723.95

PV2 =

5,332,800.00

PV3 =

4,420,342.66

PV4 =

2,197,872.86

PV5 =

-1,174,970.77

NPVt=8,212,723.95+5,332,800+4,420,342.66+2,174,970.77+-1,17 4,970.77-20,000,000

NPVt=18,988,768.7-20,000,000

NPVt=-1,174,970.77

Therefore, the net present Value (NPV) is equal to -1,174,970.77 which will be used as NPV2

Therefore, IRR (the

Internal Rate of Return) is given by the formula:

Where,

IRR= Internal rate of Return

NPV1 =

Highest NPV (with positive

value)

NPV2 =

Lowest NPV (with negative

value)

R1 = Discount rate for NPV1

R2

= Discount rate for

NPV2

Given data,

IRR= …?

NPV1 =

13,845,707.79

NPV2 =

-1,011,231.3

R1 = 0.1

R2

= 0.5

Therefore,

IRR= 0.5

IRR= 50%

Therefore, the Internal Rate of

Return is 50%.

All

in all this project (chicken rearing establishment), is worth because it has

the Net Present Value of 33,845,707.79 which is greater than zero. Also this

project will have more benefit than coast Ratio of 1.7; This shows that the

project will have more benefits than costs. The internal rate of return is 50%,

this shows the maximum interest rate that the project could pay for the

resources used if the project is to recover its investment and operating costs

and still break even.

Read More: Project Planning and Management (A Case of Kwimba District)

Hello Every One, I am Robbort Bassler From Ohio U.S.A, I quickly want to use this medium to shear a testimony on how God directed me to a Legit and real loan lender who have transformed my life from grass to grace, from being poor to a rich woman who can now boast of a healthy and wealthy life without stress or financial difficulties. After so many months of trying to get a loan on the Internet and was scammed the sum of $9,800 i became so desperate in getting a loan from a legit loan lender on-line who will not add to my pains, then i decided to contact a friend of mine who recently got a loan on-line, we discussed about the issue and to our conclusion she told me about a woman called Mrs Christina Rojas who is the C.E.O of Happiness Loan Firm So i applied for a loan sum of (750,000.00USD) with low interest rate of 3%, so the loan was approved easily without stress and all the preparations where made concerning the loan transfer and in less than two(2) days the loan was deposited into my bank so i want to advice everyone in need of a loan to quickly contact him via: Email: (Happinessloanfirm2478@hotmail.com) he does not know am doing this i pray that God will bless him for the good thing he has done in my life.

ReplyDelete